Search results : sovereign debt

2017-12-09 08:37:00 Saturday ET

2017-12-07 08:31:00 Thursday ET

2017-11-17 09:42:00 Friday ET

2017-10-15 07:38:00 Sunday ET

2017-09-03 10:44:00 Sunday ET

2017-04-25 06:35:00 Tuesday ET

2017-04-13 10:42:00 Thursday ET

2017-02-25 06:44:00 Saturday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2022-02-02 10:33:00 Wednesday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2022. As of early-January 2023, the U.S. Patent and Trademark O

2019-08-31 14:39:00 Saturday ET

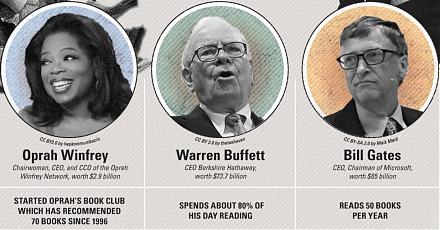

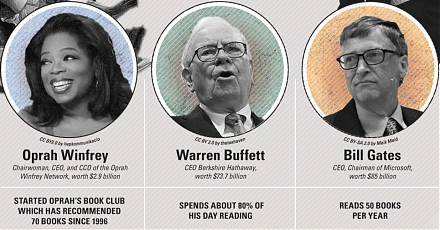

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B

2019-09-17 08:33:00 Tuesday ET

Global stock market investors foresee the harbinger of a major economic downturn. Many stock market investors become anxious due to negative term spreads an

2019-04-15 08:37:00 Monday ET

Chinese Belt-and-Road funds large international infrastructure investment projects primarily in East Asia, Central Asia, North Africa, and Italy. Chinese Be

2018-08-05 12:34:00 Sunday ET

JPMorgan Chase CEO Jamie Dimon sees great potential for 10-year government bond yields to rise to 5% in contrast to the current 3% 10-year Treasury bond yie

2019-11-03 12:30:00 Sunday ET

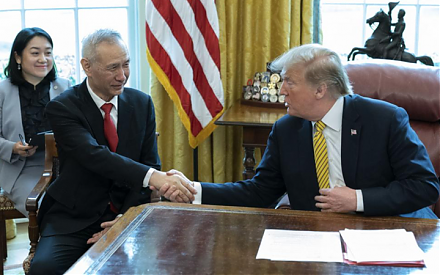

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice